Investing in real estate can be highly profitable, but success depends on making well-informed decisions backed by accurate data. Analyzing a property thoroughly before buying is essential to avoid costly mistakes and maximize returns. Fortunately, today’s investors don’t have to rely on guesswork or complicated spreadsheets—there are powerful property analysis tools designed to simplify this process.

The Best Property Analysis Tools for Real Estate Investors are designed to simplify the process, save time, improve accuracy, and provide a clear picture of your investment’s potential. From calculating cash flow to comparing deals and understanding market trends, the right tools make all the difference. In this post, we’ll explore some of the top property analysis tools available to real estate investors, including GetPropEase, a platform that combines ease of use with comprehensive features to help you invest smarter.

Why Use Property Analysis Tools?

Analyzing rental properties manually can be time-consuming and prone to errors, especially if you’re juggling multiple deals or new to real estate investing. That’s where property analysis tools come in—they help streamline the process and provide accurate, data-driven insights.

Benefits of Using Property Analysis Tools:

- Save Time: Automate complex calculations like cash flow, cap rate, and ROI, freeing you up to focus on finding the right properties.

- Increase Accuracy: Reduce human errors by relying on software that uses standardized formulas and up-to-date data.

- Compare Properties Easily: Quickly evaluate multiple deals side-by-side to identify the best investment opportunities.

- Make Informed Decisions: Access market trends, rental comps, and expense estimates to understand a property’s true potential.

- Improve Confidence: Knowing your numbers are backed by reliable tools gives you peace of mind before making offers.

Whether you’re a beginner or a seasoned investor, using the right tools can transform how you analyze properties and ultimately grow your real estate portfolio more efficiently.

Did You Know?

- Nearly 28% of real estate deals fall through due to inaccurate financial projections or hidden issues, according to the National Association of Realtors (2024).

- A 2023 BiggerPockets survey revealed that 70% of successful investors use digital tools to evaluate rental properties—replacing spreadsheets and guesswork.

- The PropTech Insights Report (2023) found that investors using purpose-built analysis software enjoy an average 23% higher ROI compared to those using manual methods.

- According to the Real Estate Technology Benchmark Study (2024), switching from spreadsheets to automated tools saves 2–3 hours per property analysis.

Top Property Analysis Tools for Real Estate Investors 2025

1. GetPropEase – Smart, Fast, and Investor-Friendly

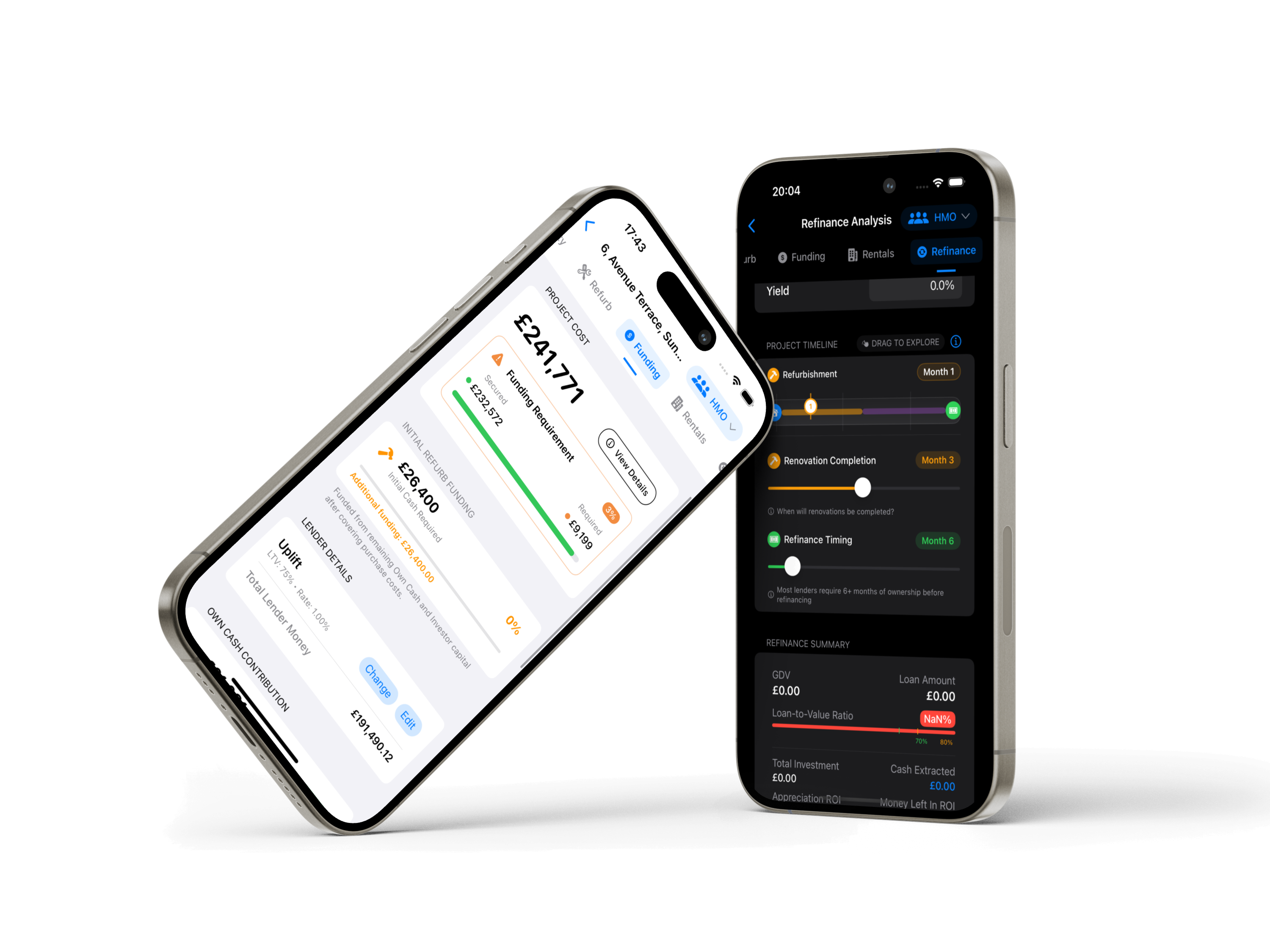

GetPropEase is an all-in-one property analysis platform designed to simplify the way investors evaluate rental properties. It’s built for both beginners and experienced investors who want to make data-driven decisions without getting buried in spreadsheets.

Key Features:

- Instant Metrics Calculation: GetPropEase automatically calculates key metrics like cash flow, cap rate, ROI, and cash-on-cash return.

- Market Insights: It offers built-in access to rent estimates, vacancy rates, and local market trends, so you can understand the true value of a deal.

- Custom Scenario Testing: You can test different financial scenarios—down payments, interest rates, expenses—and instantly see how they affect profitability.

- User-Friendly Dashboard: The clean, intuitive interface makes complex data easy to understand, even for new investors.

Export Reports: Generate deal summaries to share with partners, lenders, or clients in just a few clicks.

Why It Stands Out:

Unlike traditional tools, GetPropEase combines speed, accuracy, and simplicity—all in one place. Whether you’re screening one deal or comparing multiple properties, it helps you make smarter decisions, faster.

2. DealCheck – The Go-To Tool for Analyzing Rental Properties and Flips

DealCheck is one of the most widely used property analysis tools by real estate investors across the globe. Known for its versatility and powerful features, it’s ideal for analyzing rental properties, fix-and-flips, BRRRR deals, and even multifamily buildings.

Key Features:

- Comprehensive Deal Calculator: DealCheck helps you evaluate cash flow, cap rate, purchase costs, rehab budgets, and long-term returns with ease.

- Property Comparison: Easily compare multiple deals side by side to determine which investment offers the best return.

- Built-in Data Sync: Import property details directly from public listings, including Zillow, to save time and reduce manual entry.

- Customizable Reports: Generate branded reports to share with partners, clients, or lenders—great for presentations or pitch decks.

- Cloud-Based Access: Analyze deals on your desktop or mobile device, with synced data across platforms.

Why It Stands Out:

DealCheck is perfect for both beginners and seasoned investors thanks to its depth, speed, and clean layout. It not only performs detailed calculations but also helps you quickly decide whether a deal is worth pursuing.

3. Rentometer – Fast and Reliable Rent Comparison Tool

Rentometer is a specialized tool that helps investors, landlords, and property managers determine if their rental rates are competitive within the local market. It’s simple, effective, and extremely useful when analyzing rental income potential.

Key Features:

- Instant Rent Comparisons: Enter an address, unit type, and rent amount to see how it stacks up against other rentals in the area.

- Market Summary Reports: Get insights on average rent prices, rent ranges, and rental trends for specific neighborhoods or zip codes.

- Customizable Radius: Adjust the comparison area (e.g., 1 mile, 3 miles) to fine-tune your analysis to hyper-local data.

- Pro Reports: Paid plans offer access to more detailed analytics, including historical rent trends and charts.

- Simple Interface: Clean layout and fast results make it ideal for quick pricing checks and rental projections.

Why It Stands Out:

When estimating rental income, Rentometer offers unmatched simplicity and speed. It’s especially valuable during the initial deal screening phase when you’re trying to verify whether projected rental income is realistic.

4. BiggerPockets Rental Property Calculator – Trusted by the Real Estate Community

The BiggerPockets Rental Property Calculator is one of the most beginner-friendly tools available. Built by the well-known real estate investing platform, BiggerPockets, it’s a favorite among new and experienced investors alike for quick and reliable rental property analysis.

Key Features:

- Simple Input System: Just plug in basic numbers—purchase price, loan terms, rent, expenses—and the tool handles the math.

- Core Metrics: Calculates cash flow, cash-on-cash return, cap rate, and total return over time.

- Custom Assumptions: Modify variables like vacancy rates, maintenance costs, and appreciation to test different scenarios.

- One-Click Reports: Generate clean, visual reports to print or share with others.

- Online Community Access: Use alongside BiggerPockets forums and content to get support and insights from other investors.

Why It Stands Out:

This tool is perfect for those just starting out who want a simple, no-frills way to understand a property’s financials. Plus, it’s backed by one of the most trusted names in real estate education.

Essential Features of Property Analysis Tools

Not all property analysis tools are created equal. Whether you’re a new investor or managing a growing portfolio, choosing a tool with the right features can help you make faster, more accurate investment decisions. Here are the key features to look for:

- Core Investment Metrics

Your tool should automatically calculate essential metrics like:

- Cash Flow

- Cap Rate

- ROI (Return on Investment)

- Cash-on-Cash Return

- IRR (for advanced users)

These indicators help you evaluate if a deal meets your financial goals.

- Scenario Testing & Custom Inputs

The ability to test various financial scenarios—such as changing loan terms, rent prices, or repair costs—lets you plan for best- and worst-case outcomes.

- Market Data Integration

Look for tools that pull real-time data like local rent comps, property values, and vacancy rates. This helps you stay aligned with current market conditions.

- User-Friendly Interface

A clean, intuitive design saves time and reduces errors. If the tool is too complex or clunky, it defeats the purpose.

- Reporting and Export Options

Being able to generate reports—especially branded or shareable ones—is a big plus if you work with partners, lenders, or clients.

- Mobile or Cloud Access

Cloud-based tools or mobile apps allow you to analyze deals from anywhere, even on the go.

Conclusion

Choosing the right property analysis tools is crucial for real estate investors who want to make informed, data-driven decisions and maximize their returns. With features like instant financial metrics, scenario testing, and real-time market data, these tools simplify the complex process of evaluating rental properties and investment deals.

From beginner-friendly calculators like BiggerPockets to advanced platforms like PropertyREI, there’s a tool for every investor’s needs. By leveraging these resources, you can save time, reduce risks, and confidently build a successful real estate portfolio.

Take the time to explore these top tools and find the one that fits your investment strategy best — your future self will thank you.