Think your rental deal is a winner? Nearly 1 in 3 first-time investors learn the hard way.According to a 2023 study by the National Association of Realtors, almost 30% of new real estate investors encounter unexpected costs or poor cash flow within their first year, often due to rushed or incomplete property analysis.

Real estate can be a powerful path to financial freedom—but only if you understand the numbers. Skipping proper analysis can turn a great opportunity into a financial drain.

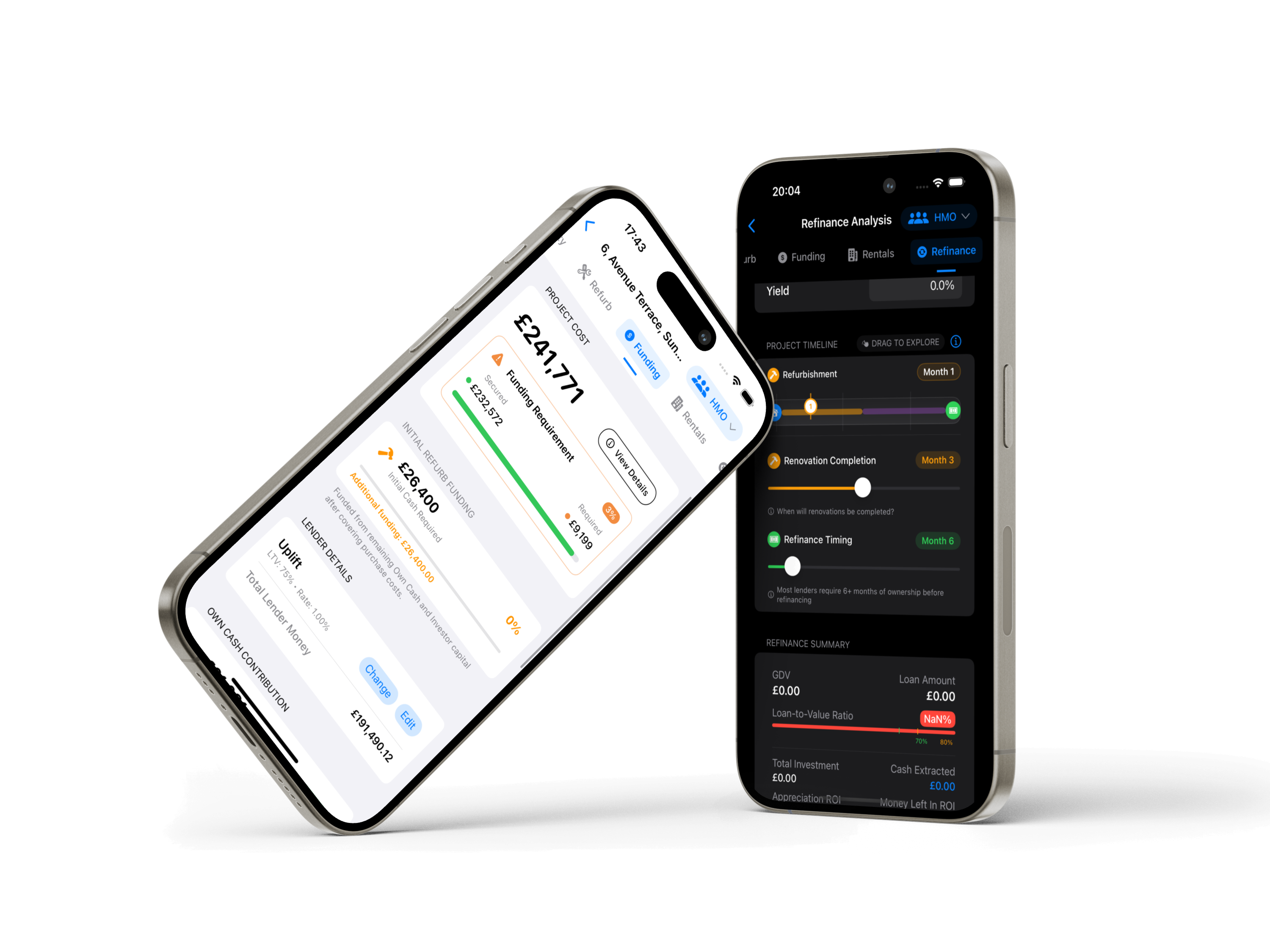

This guide will walk you through the essentials of how to analyze a rental property, step by step . Whether you’re a beginner or refining your strategy, this guide, paired with smart tools like GetPropEase, will help you invest with confidence and clarity.

1. Why You Should Analyze a Rental Property Before You Invest

Investing in rental properties offers the potential for steady income and long-term wealth—but it’s not risk-free. Too many investors rely on instincts or hearsay, leading to common mistakes like:

• Unexpected maintenance costs

• Extended vacancy periods

• Negative cash flow

Proper analysis helps you:

• Avoid surprises: Uncover hidden costs before it’s too late

• Ensure profitability: Confirm that rent covers expenses and generates income

• Compare deals objectively: Use data, not emotions, to make decisions

• Plan for the long term: Evaluate appreciation potential and market stability

In short, smart investors analyze—before they buy.

2. What Data Do Smart Investors Always Gather?

Before you run the numbers, you need the facts. Collecting accurate data helps you avoid miscalculations and confidently assess any deal. Essential Data to Gather:

• Purchase Price: Total acquisition cost including closing fees

• Estimated Rent: Based on comparable rentals in the area

• Property Taxes: Annual local taxes

• Insurance: Yearly coverage cost

• Maintenance & Repairs: Ongoing upkeep estimates

• Property Management Fees: Typically 8–10% of rental income

• Vacancy Rate: The Time the property may remain unoccupied

• Utilities: If covered by you, the landlord may seem like a lot, but platforms like GetPropEase make data collection simple and centralized.

3. The 4 Numbers That Make or Break Your Deal

Once you have the data, it’s time to run the numbers. These investment metrics reveal whether the property is a smart move.

1. Cash Flow

Your monthly profit after all expenses.

Formula:

Monthly Rent – Monthly Expenses = Cash FlowPositive cash flow = profit. Negative = potential red flag.

2. Cap Rate (Capitalization Rate)

Shows ROI if you paid all cash.

Formula:

(Net Operating Income ÷ Property Price) × 100Higher cap rates often signal better returns—but sometimes higher risk.

3. Cash-on-Cash Return

Measures return based on your actual cash invested (e.g., deposit, fees).

Formula:

(Annual Cash Flow ÷ Total Cash Invested) × 100 This is your true return on the money you’ve put in.

4. Net Operating Income (NOI)

Income from rent minus all operating expenses (excluding mortgage).

Helps assess a property’s core profitability.

Tip: Manual calculations can be slow and error-prone. GetPropEase instantly calculates these metrics, saving time and increasing accuracy.

4. How to Evaluate the Market and Location

Even a well-priced property can fail if it’s in a bad location. Market research is just as important as the numbers.

Key Factors to Consider:

• Job Market & Local Economy: Strong job growth attracts stable tenants

• Population Trends: Growing areas = higher rental demand

• School Ratings: Good schools attract long-term family renters

• Crime Rates: Lower crime = higher desirability

• Vacancy Rates: High vacancy = potential red flag

• Rent Trends: Are rents rising, flat, or falling?

GetPropEase provides local insights and trends to help you make smarter location decisions before you invest

5. Why GetPropEase Is Your Secret Weapon

Analyzing a deal manually takes time. Mistakes are easy.

That’s where GetPropEase makes all the difference.

Key Benefits:

• Centralized Property Data: Keep all your numbers in one place

• Auto-Calculated Metrics: Instant insights with zero math

• Built-in Market Research: Understand trends, vacancy rates, and rent levels

• Scenario Testing: Change rental income or loan terms and see instant impact

• Intuitive Design: Easy for beginners, powerful for GetPropEase helps you go from guessing to knowing.

Conclusion

Proper rental property analysis isn’t optional—it’s essential. When you analyze thoroughly, you avoid costly mistakes and set yourself up for long-term success.

Tools like GetPropEase make that process simple, fast, and accurate—whether you’re buying your first property or your fiftieth.Ready to invest smarter?

Try GetPropEase today and turn your next deal into your best decision yet.