Why These Rules Matter

Real estate investing isn’t guesswork—it’s a disciplined, data-driven path to long-term wealth. Whether you’re acquiring your first rental or scaling a portfolio, the most successful investors follow proven principles that maximize returns and minimize costly mistakes.

This guide breaks down the 10 golden rules that every serious investor should follow. These aren’t just theories—they’re the playbook of top property professionals. If you want sustainable income, steady appreciation, and fewer sleepless nights, start here.

Rule 1: Set Clear Investment Goals

Every successful portfolio begins with a goal. Ask yourself:

- Are you chasing monthly cash flow, capital appreciation, or both?

- Do you want to retire early, replace your income, or build generational wealth?

Set measurable, time-bound goals—e.g. “Buy 2 HMOs in Manchester generating £500/month cash flow each within 12 months.”

Why It Matters:

- Keeps you focused when opportunities (or distractions) arise.

- Helps filter deals based on ROI and strategy fit.

- Drives financing, location, and property type decisions.

🎯 Pro Tip: Revisit your goals quarterly. Property markets shift—and so do your circumstances.

Rule 2: Know Your Market Inside Out

A great deal in the wrong market is still a bad investment. Mastering your chosen location gives you an unfair advantage.

Key Factors to Analyze:

- Local job growth and employer trends

- Supply & demand for rental units

- Population and infrastructure changes

- School catchments and transport links

- Rental yield and vacancy rate patterns

Skip this, and you risk owning a “nice” property that no one wants to rent.

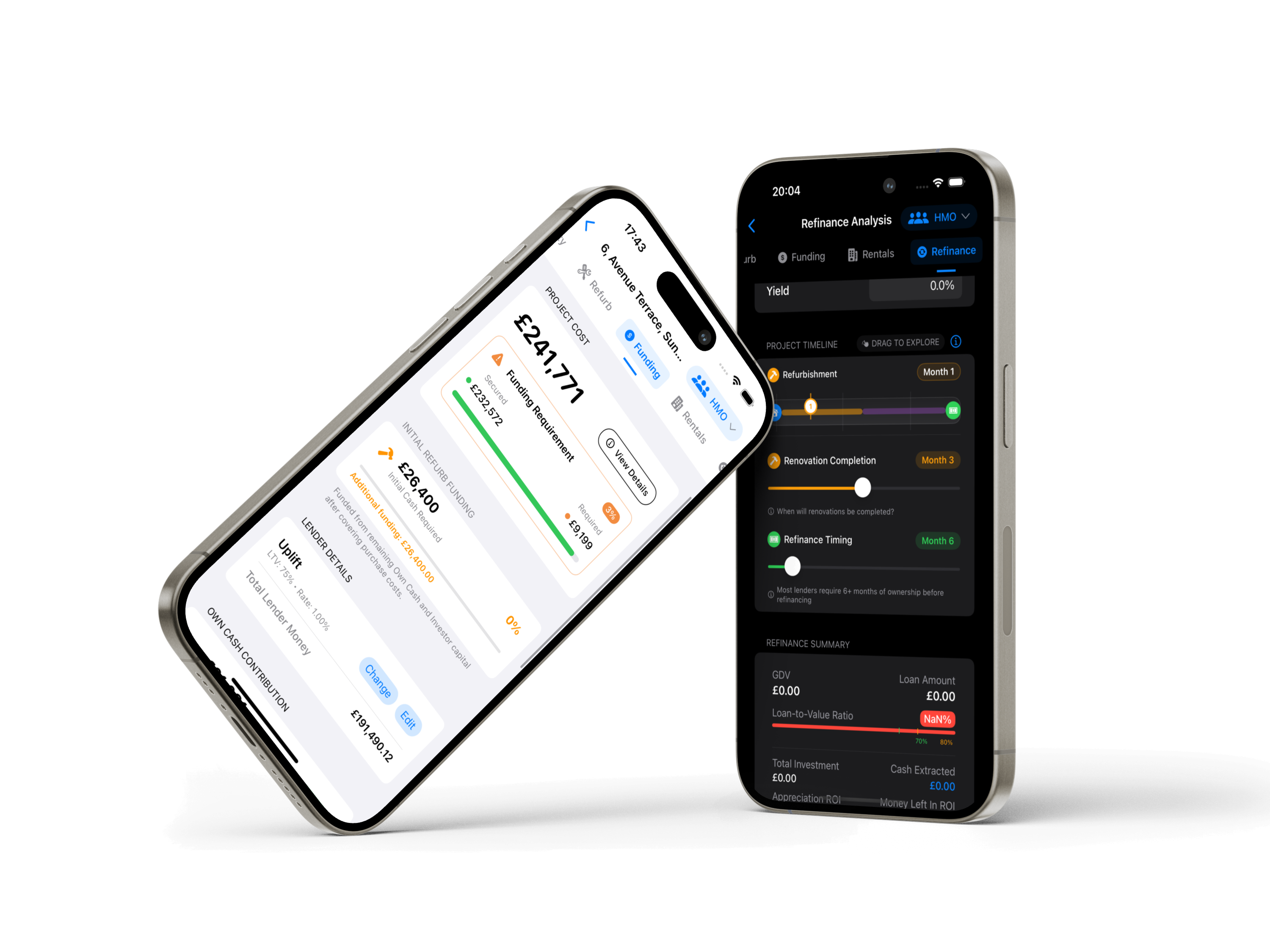

💡 Tools: Use platforms like GetPropEase, PropertyData, or Rightmove Insights to assess demand, rent trends, and competition.

📢 Pro Tip: Talk to local agents and let managers—they’ll tell you what the spreadsheets don’t.

Rule 3: Secure Strategic Financing

Financing can make or break your returns. Choose the structure that aligns with your investment strategy, risk tolerance, and scaling goals.

Know Your Options:

- Buy-to-let mortgages

- Bridging and development finance

- Joint ventures or private investors

- Limited company structures

Watch for:

- Fixed vs. variable rates

- LTV ratios and exit terms

- Fees, penalties, and cash flow impact

💰 Pro Tip: Always maintain a buffer. Good financing protects you from market shocks, interest rate hikes, and unforeseen expenses.

Rule 4: Buy the Right Property, Not Just a Cheap One

Cheap properties can be expensive mistakes. Focus on value and performance, not price alone.

Key Criteria:

- Location desirability (schools, transport, jobs)

- Condition & refurbishment needs

- Target tenant demand (e.g. students vs. families)

- Legal/zoning issues (e.g. Article 4, planning)

🔢 Run the Numbers:

Use tools to calculate:

- Gross and net yield

- Cash flow

- Cap rate

- Return on investment (ROI)

🌟 Pro Tip: Walk the area at different times of day. Online data can’t replace boots-on-the-ground insight.

Rule 5: Master the Numbers

Top investors treat property like a business. That means understanding every line item that affects profitability.

Always Calculate:

- Gross rental income

- Operating expenses (taxes, insurance, voids, repairs)

- Net Operating Income (NOI)

- Cash-on-cash return

- Break-even point

📊 Tools: Use GetPropEase to stress-test your deal against worst-case and best-case scenarios.

💭 Pro Tip: Always underestimate income and overestimate costs. That way, your worst-case still works.

Rule 6: Build a Power Team

You can’t scale alone. Build a reliable team to support you:

- Investor-friendly estate agent

- Mortgage broker

- Solicitor

- Accountant

- Builder or handyman

- Property manager

🔍 Pro Tip: Vet your team like you vet your deals. References, track record, and communication are key.

Rule 7: Always Do Your Due Diligence

Due diligence isn’t optional. It’s your defense against bad deals.

Checklist:

- Structural survey & condition report

- Legal/title checks

- Area analysis (crime, schools, amenities)

- Rent comparables

- Planning, zoning, and Article 4 status

🔹 Pro Tip: Trust but verify. Get documents. Ask questions. Walk the property.

Rule 8: Think Long-Term

Flips are flashy, but buy-and-hold builds real wealth.

Long-Term Advantages:

- Mortgage paydown by tenants

- Property appreciation

- Stable rental income

- Tax benefits (depreciation, CGT relief, etc.)

💼 Pro Tip: Don’t chase fads. Focus on fundamentals and compound returns.

Rule 9: Stay Educated & Adapt

The market evolves. So should you. Top investors read, network, and upskill constantly.

Ways to Stay Sharp:

- Read books & blogs (e.g. BiggerPockets, PropertyHub)

- Attend meetups and webinars

- Take courses on finance, legal, and tax

- Follow UK-specific housing news & policy updates

🔧 Pro Tip: What worked in 2020 may not work in 2025. Stay ahead of the curve.

Rule 10: Always Have an Exit Plan

Before you buy, know how you’ll exit.

Options:

- Sell for capital gain

- Refinance to extract equity

- 1031 Exchange (US) or tax deferral (UK strategies)

- Hold long-term for cash flow

- Pass into a trust or estate

📆 Pro Tip: Your exit shapes your entry. Structure finance, ownership, and timelines with the end in mind.

Final Thoughts: Play the Long Game

Success in real estate isn’t about luck or timing. It’s about strategy, systems, and staying power.

Follow these 10 golden rules, and you’ll build not just a portfolio—but a business that grows, protects, and sustains your wealth for decades to come.

📉 Start smarter. Invest sharper. Build faster.

Ready to simplify your next deal? Try GetPropEase today.